While people are trying to come to terms with the changes COVID-19 is bringing to our lives, “a mass of stomach-churning volatilities in this year,” as the Economist (2022) called it. The Nasdaq stock index has dropped nearly 30 percent since January, the Russia-Ukraine war since February, the energy crisis, the infection rate of the pandemic is rising with global warming. Unlike the gloomy world situation, the art market in 2022 is showing a different picture. This article will introduce the performance and highlights of the art auction market in the first half of this year by the four major auction houses — Christie’s, Sotheby’s, Phillips and China Guardian, the differences between the records of the same period last year, and the Asian art market presence.

The report, RawFacts Auction Review First Half 2022 from ArtTactic, the art market research company, notes that Christie’s, Sotheby’s and Phillips have sold a combined $7.4 billion, up 25 per cent from the same period last year. Christie’s led the way with 49.2% of the market, followed by Sotheby’s with nearly 43% and Phillips with about 8%. Christie’s sales rose 18 percent this year to $4.1 billion compared with the first half of 2021. Sotheby’s sales rose 12 percent to $3.17 billion. Phillips’ sales rose 38 percent to $587 million. Therefore, from the current data, after the strong rebound in 2021, the overall art auction market in 2022 still shows an upward trend.

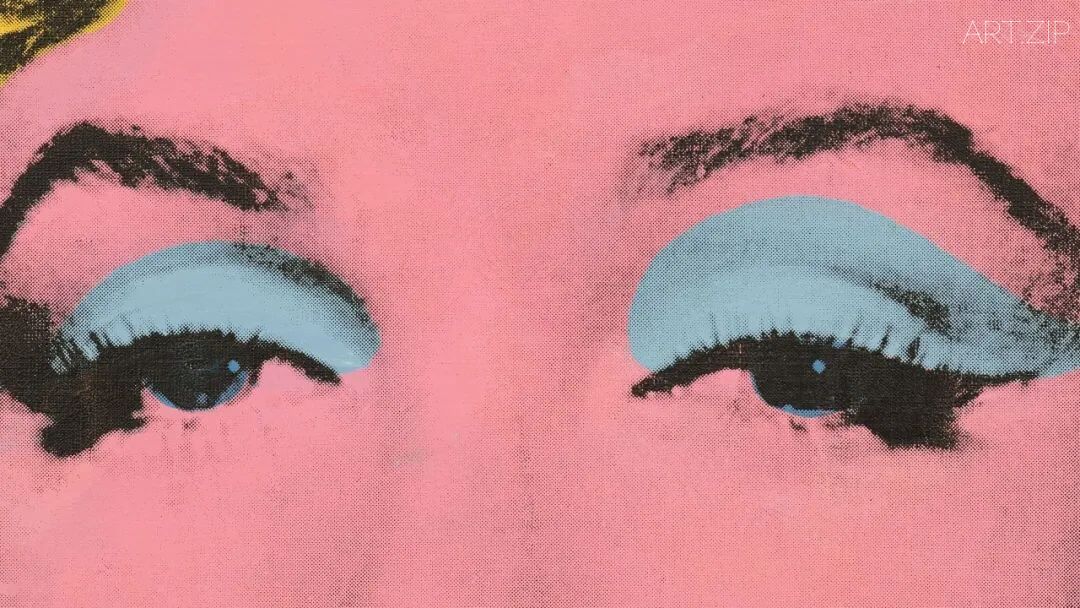

One of the most conspicuous works is Shot Sage Blue Marilyn (1964), which is Andy Warhol’s silkscreen portrait of Marilyn Monroe. At Christie’s Thomas and Doris Ammann Collection evening sale in New York on May 9, it sold for a record $195 million (includes commission). The result makes it become the most expensive 20th century artwork ever sold at auction. Christie’s chief executive officer Guillaume Cerutti said on a 12 July news conference that the auction house sold 87% of its works in the first half of this year. It demonstrated that the global market can absorb most of the works the house offers at every price category, not limited to masterpieces.

However, is everywhere sanguine in the art market against a backdrop of global economic turmoil?

Mr Cerutti also acknowledged that the market is showing some noticeable gaps. So far, art has proved to be largely immune to the downward pressure currently battering stocks and cryptocurrency assets, but fears of a possible recession still loom. The biggest potential sign is that Asian bidders appear to be slowing down — 44% of buyers in the first half of this year were from the Americas, 34% were from Europe, Middle East and Africa, and another 22% were from Asia. However, Asian buyers set 39% last year which is the highest record (Villa, 2022). This year is down about 44 percent from last year. In Hong Kong, for example, sales at Christie’s, Sotheby’s and Phillips were down 30.2 percent from last year (Kazakina, 2022).

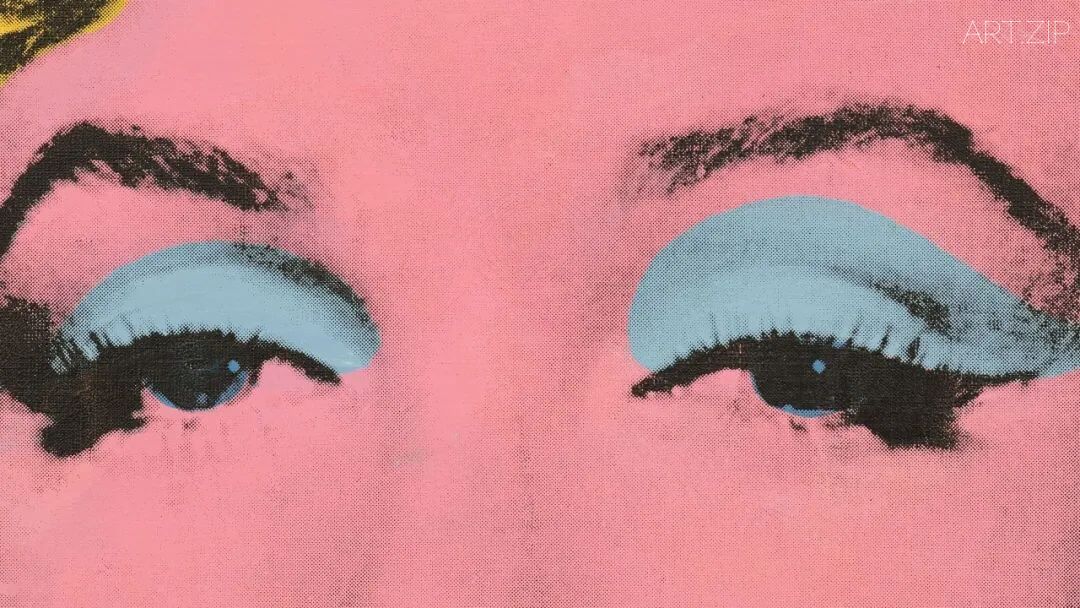

Buste d’homme dans un cadre by Pablo Picasso (1969) © Christie’s

Pablo Picasso’s 1969 painting, Buste d ‘Homme Dans UN Cadre sold for $22 million at Christie’s Hong Kong Modern and Contemporary Art evening, making it the second most expensive work in the region. But it falls far short of its global auction record of $179.4 million (Villa, 2022). Christie’s sold $428 million in Hong Kong, down from $458 million in May last year. The record $231 million for 20/21st Century Art night was down 10 percent from last year. Sotheby’s record last April was $496 million, down to $491 million this year. Modern and Contemporary Art night shows are down 30% from 2021. Phillips is down nearly 50% from last June (Kazakina, 2022).

This may confirm what cultural economist and founder of Art Economics Dr Claire McAndrew pointed out in the Art Basel 2022 and UBS Global Markets Report: While we consider China to be a normal modern market with real purchasing power, it still lags behind in terms of infrastructure. The market has not been around long enough (2022). During this year, the zero-COVID strategy in China and Hong Kong’s strict travel restrictions in the face of the fifth wave of COVID-19 are causing a big shock to the economic market. Finished on 29th June, China Guardian held the only major spring auction in Mainland China in Beijing. Although the organizer has tried to minimize the impact of the quarantine policy by using online publicity, such as live broadcasts, Tik Tok and online auctions, the final total was still disappointing — the record 1.471 billion yuan ($271 million) was 36.79 percent lower than last spring’s auction. It is also the lowest of 26 major auctions since the fall auction in 2009.

Overall, the art auction market is on the upswing, but the Asian market is more influenced by reality. The total sales of the three major Western auction houses were relatively optimistic, but China Guardian, which focuses on Chinese customers, was hit hard. The government’s move could bring a new atmosphere to the art market. How will things change in the second half of 2022? Let’s wait and see.

當人們正試圖接受新冠疫情給生活所帶來的改變時,如《經濟學人》雜誌(2022)所稱 — ‘大量令人反胃的波動’又接踵而至。從今年一月起納斯達克(the nasdaq)下跌近30%的股票指數,二月份開始的俄烏戰爭,能源危機,新冠感染率和全球化變暖的氣溫一樣高居不下。與低沉的世界局勢不同,2022年上半年藝術市場總體正在呈現出另一番景象。本篇文章將會介紹全球四大拍賣行佳士得(Christie’s)、蘇富比(Sotheby’s)、富艺斯(Phillips)和中國嘉德(China Guardian)在今年上半年的藝術拍賣市場表現、亮點,和去年同期紀錄的差異,以及亞洲藝術市場的表現。

藝術市場研究公司ArtTactic在針對2022年上半年拍賣行情的一份報告中指出,佳士得、蘇富比和富艺斯拍賣行目前的拍賣總額為74億美元,較去年同期增長25%。市場份額由佳士得以49.2%的占比為首,蘇富比和富艺斯則分別占據了近43%和近8%。比較2021年上半年,佳士得在今年的銷售額增長了18%,實現了41億美元。蘇富比的銷售額增長了12%,達到31.7億美元。富艺斯的銷售額增長了38%,達到5.87億美元。因此從目前的總體數據上來看,在經歷了藝術市場表現強勁反彈的2021年後, 2022年的藝術拍賣市場總體依然呈現出上升趨勢。

其中最引人注目的作品之一是在5月9日紐約,佳士得舉辦的Thomas and Doris Ammann收藏夜場拍賣上,安迪·沃霍爾(Andy Warhol) 於1964年拍攝的瑪麗蓮·夢露(Marilyn Monroe)絲印肖像,《Shot Sage Blue Marilyn》,以創紀錄的1.95億美元(含傭金)拍出。這一結果使它成為20世紀藝術家有史以來在拍賣會上售出的最昂貴的作品。佳士得首席執行長塞魯提(Guillaume Cerutti)在7月12日的新聞發佈會上表示,該拍賣行今年上半年售出了87%的作品。這說明全球市場能夠消化掉該拍賣行在各個價位上推出的幾乎所有東西,而不僅僅是名作。

然而,在這樣一個全球動蕩的背景下,藝術市場的一切都是那麼樂觀的嗎?

塞魯提同樣承認,市場顯示出了一些值得關注的漏洞。到目前為止,藝術品已被證明在很大程度上不受目前重創股票和加密貨幣資產的下行壓力的影響,但對可能出現的衰退的擔憂仍在逼近。潛在的最大跡象是:亞洲競標者似乎正在放緩腳步 — 今年上半年44%的買家來自美洲,34%的買家來自歐洲、中東和非洲,另外的22%來自亞洲,而去年亞洲創下了歷史最高紀錄39% (Villa, 2022)。 今年相比與去年相比大幅下降約44%。

以香港為例,佳士得、蘇富比和富艺斯的成交金額比去年下降了30.2%。在佳士得香港現當代藝術拍賣晚會巴勃羅·畢加索(Pablo Picasso)1969年的油畫《英雄的雕像(Buste d’homme dans un cadre)》 最終以2200萬美元的價格成交,是該地區第二昂貴的作品。但與其1.794億美元的全球拍賣紀錄相去甚遠(Villa, 2022)。佳士得從去年五月份在香港4.58億美元的拍賣成績下降到了4.28億美元。20/21世紀藝術夜場的2.31億美元紀錄比去年下降了10%。蘇富比去年四月的紀錄為4.96億美元,而今年下降為4.91億。現代與當代藝術夜場比2021年下降了30%。富艺斯則相比於去年6月下降了近50% (Kazakina, 2022)。

這或許印證了文化經濟學家、藝術經濟學創始人克萊爾·麥克安德魯博士撰寫的《2022年巴塞爾藝術展和瑞銀全球市場報告》所指出的:儘管我們認為中國是一個正常的現代市場,有真正的購買力,但在基礎設施方面依舊有待加強。市場存在的時間還不夠長(2022)。中國在面對第五波新冠疫情的‘清零’政策與香港嚴格的旅行限制,對經濟市場帶來了巨大沖擊。在今年上半年,中國內地唯一一場由中國嘉德在北京舉辦的春季大型拍賣會上,儘管主辦方已經盡可能地利用網路宣傳和線上拍賣等方式減少隔離政策帶來的影響,最後的成交總額依然不如人意 — 14.71億人民幣(2.71億美元)的紀錄比去年春拍減少了36.79%,在2009年秋拍以來的26屆大型拍賣中墊底。

綜合來看,藝術拍賣市場總體呈現出上升勢頭,但亞洲市場則受現實因素影響更大。三大西方拍賣行的總拍賣額相對來說還比較樂觀,但以中國客戶為主的中國嘉德拍賣行受到的極大衝擊。2022年下半年的情況還會如何改變?請讓我們拭目以待。